Mortgage Calculator

Project Description:

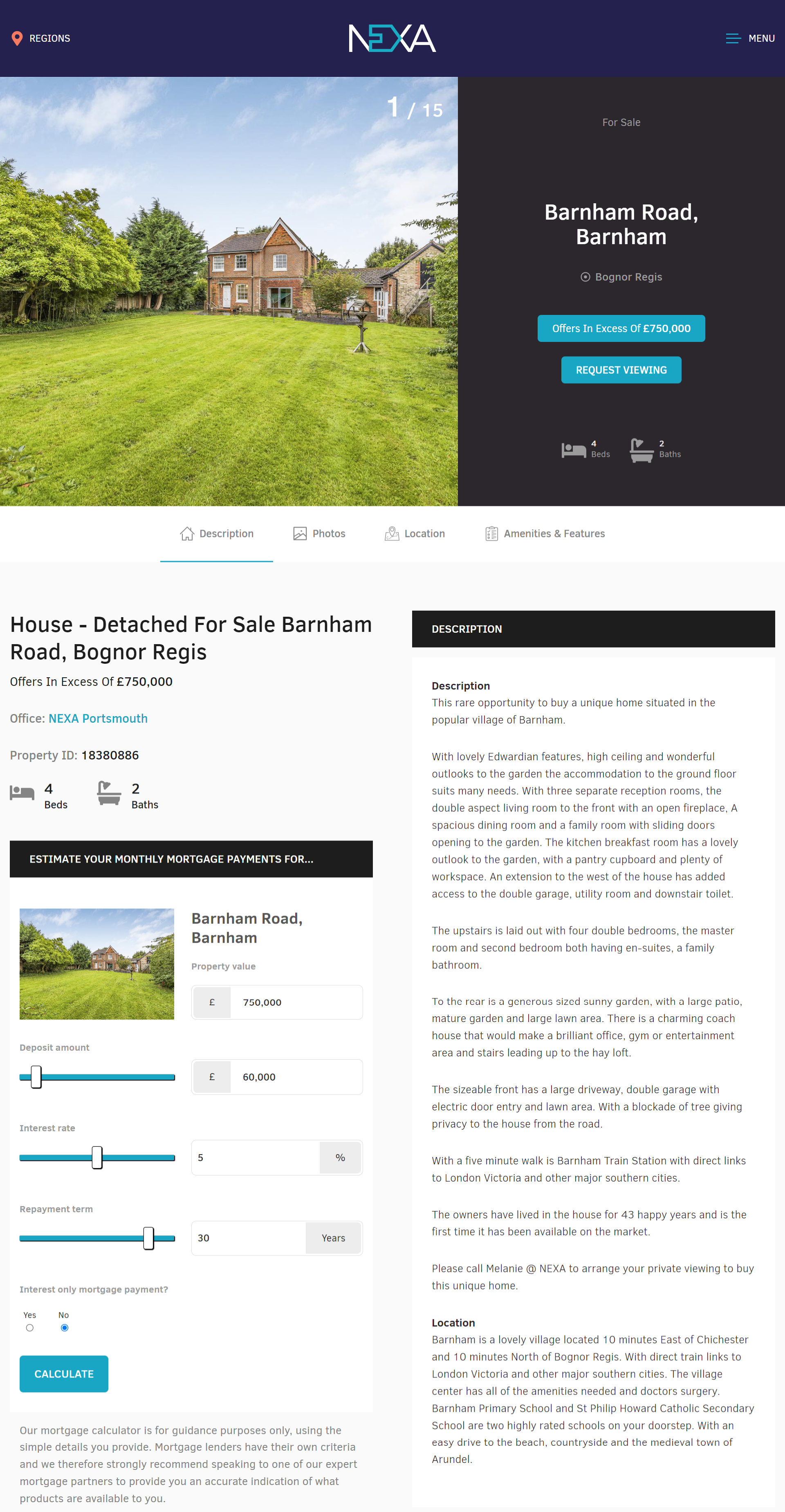

Embark on a journey of empowerment and innovation with NEXA Properties, a leading estate agency in England, UK, as we unveil the transformative impact of incorporating a mortgage calculator into our listings.

Services Rendered:

- Web Design & Development

- Website Management & Maintenance

- Server Management & Maintenance

The overview

Objectives of the Project

Understanding the Basics of Mortgage Calculators

At its core, a mortgage calculator is an online tool that allows homebuyers to estimate their monthly mortgage payments based on various factors such as loan amount, interest rate, and loan term. These calculators take into account complex mathematical formulas and provide users with instant results, saving them the hassle of manual calculations.

The Growing Importance of Mortgage Calculators in Estate Agency Listings

With the advent of the internet, homebuyers now have access to a wealth of information at their fingertips. They can research homes, explore neighborhoods, and gather financial data with just a few. As a result, estate agencies are expected to provide comprehensive and user-friendly listings to attract potential buyers. Incorporating a mortgage calculator into your property listings can significantly enhance the overall experience for buyers, setting your agency apart from the competition.

What to expect from this showcase

I will highlight how incorporating a mortgage calculator into NEXA Properties’ listings, offered a myriad of benefits for both NEXA and potential property buyers. From empowering buyers to make informed decisions to amplifying the competency of the estate agency, these tool has become indispensable to the business.

Building the concept

Streamlining the Homebuying Experience: How Mortgage Calculators Benefit Potential Buyers

Buying a home is often one of the most significant financial decisions a person will make in their lifetime. NEXA’s mortgage calculators streamlined the homebuying process by empowering buyers to assess affordability and budgeting, enhancing transparency, and facilitating informed decision-making.

Empowering Buyers to Assess Affordability and Budgeting

1. Calculating Monthly Mortgage Payments

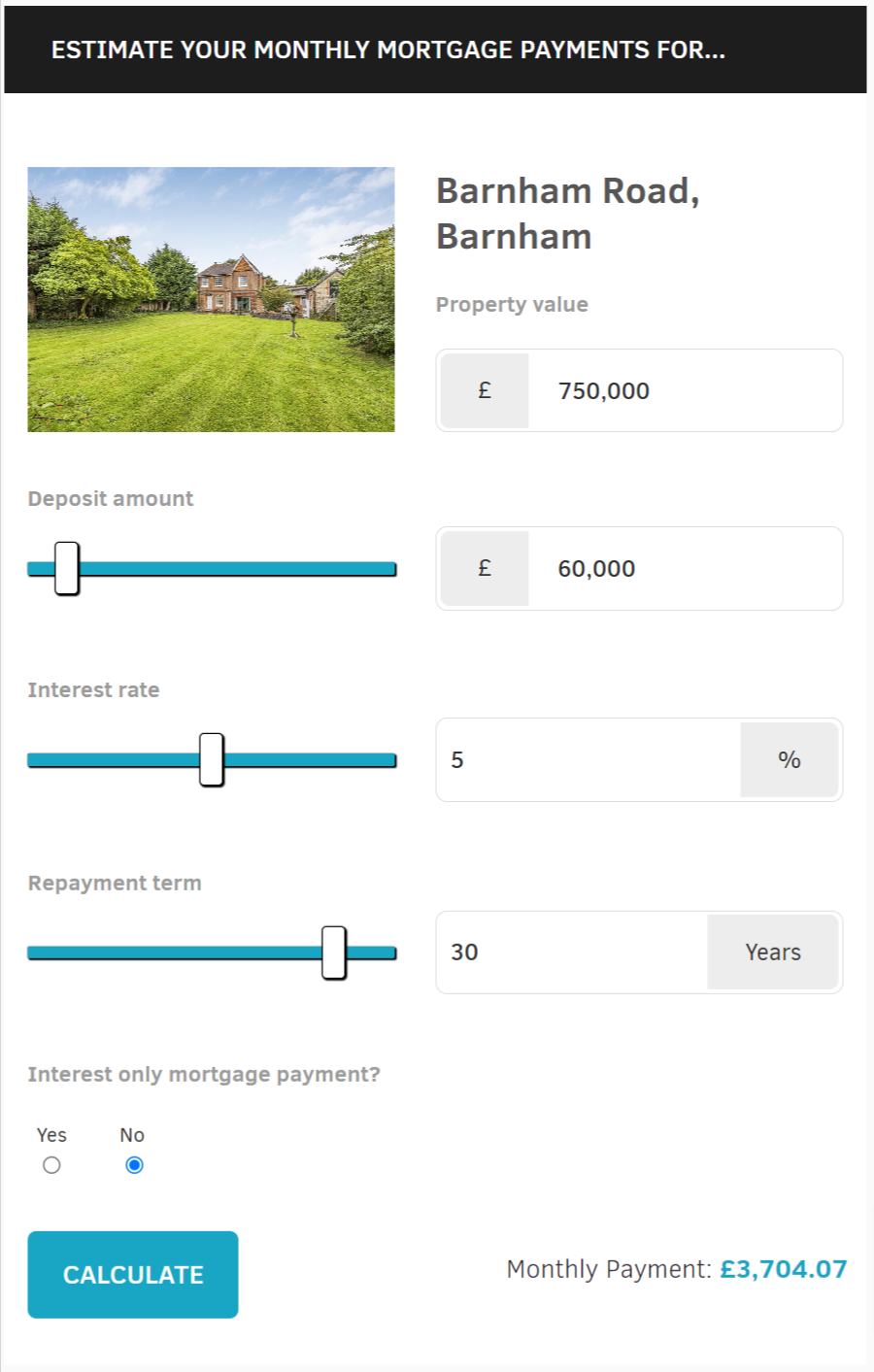

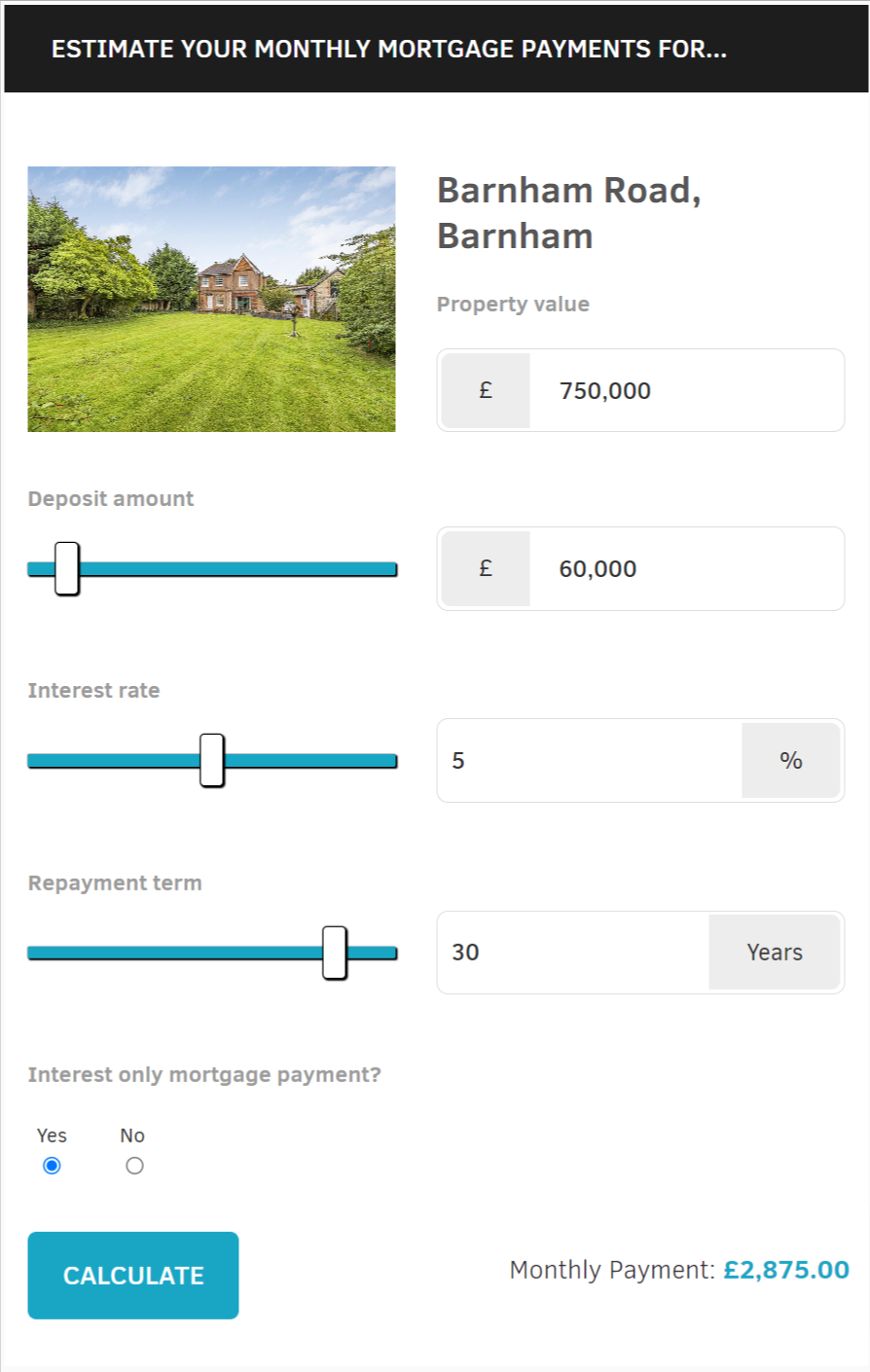

The mortgage calculator allowed buyers to enter various loan parameters such as loan amount, interest rate, and loan term, and instantly calculated the estimated monthly mortgage payment. This helped buyers determine if they could comfortably afford the property they were interested in.

2. Evaluating Different Mortgage Scenarios

The mortgage calculator enabled buyers to explore various mortgage scenarios by adjusting parameters such as down payment amount, interest rate, and loan term. This flexibility allowed buyers to compare options and make more informed decisions.

3. Determining Down Payment Requirements

By inputting different down payment amounts into the calculator, buyers could assess the impact on their monthly mortgage payment and overall affordability. This information helped buyers plan their finances and set realistic goals.

Enhancing Transparency and Reducing Stress in Home Financing

1. Assessing Mortgage Options and APRs

The mortgage calculator provided buyers with a clear breakdown of their mortgage options, including interest rates and annual percentage rates (APRs). Understanding these figures is crucial for comparing different loan offers and evaluating the long-term financial implications.

2. Understanding the Impact of Interest Rates

Interest rates play a significant role in determining the total cost of a mortgage. The mortgage calculator allowed buyers to visualize the impact of varying interest rates on their monthly payments, enabling them to make more strategic decisions.

3. Visualizing Long-term Financial Commitments

By calculating the total interest paid over the life of a loan, the mortgage calculator helped buyers comprehend the long-term financial commitment associated with homeownership. This transparency enabled buyers to plan their finances accordingly and avoid unnecessary stress.

Facilitating Informed Decision-Making for Homebuyers

1. Planning Debt Management and Future Expenses

The mortgage calculator equipped buyers with the information they needed to plan their debt management effectively. By factoring in their estimated monthly mortgage payment, buyers could assess how it aligned with their overall financial goals and other anticipated expenses.

2. Recognizing the Tax Implications of Different Mortgages

Different mortgage options can have varying tax implications for homeowners. The mortgage calculator helped buyers comprehend the tax benefits associated with different loan scenarios, enabling them to make financially sound decisions.

3. Identifying the Optimal Mortgage for Individual Needs

Every homebuyer has unique financial circumstances and goals. The mortgage calculator provided buyers with the tools to identify the optimal mortgage option that aligned with their individual needs. This tailored approach ensured buyers made informed choices that suited their long-term financial objectives.

Impressive result

Amplifying the Competency of Estate Agencies: Benefits of Embedding Mortgage Calculators

We leveraged the power of mortgage calculators to attract and engage potential buyers, generate qualified leads, and showcase NEXA’s industry expertise.

Attracting and Engaging Potential Buyers

1. Offering an Interactive and Personalized User Experience

By integrating a mortgage calculator into NEXA’s property listings, we created an interactive and personalized experience for potential buyers. This engagement not only captivated buyers but also elevated the agency’s reputation as a forward-thinking and customer-centric organization.

2. Expanding Accessibility and Convenience for Buyers

The mortgage calculator provided potential buyers with the convenience of exploring their financial options instantly. This accessibility demonstrated NEXA’s commitment to transparency and simplified the decision-making process for buyers.

3. Building Trust through Transparency and Professionalism

Incorporating a mortgage calculator into NEXA’s listings highlighted the agency’s dedication to providing transparent and accurate information. This commitment built trust with potential buyers and positioned NEXA as a reliable source of expertise in the real estate market.

Generating Qualified Leads and Driving Sales Conversion

1. Capturing Valuable User Data for Targeted Marketing

The mortgage calculator collected valuable user data that was leveraged for targeted marketing campaigns. With this information, we were able to personalize NEXA’s marketing efforts and engage with potential buyers more effectively.

2. Facilitating More Efficient Sales Processes

The mortgage calculator streamlined the sales process by allowing potential buyers to pre-qualify themselves based on their financial capabilities. This pre-qualification saved time for NEXA’s agents, enabling them to focus their efforts on qualified leads and closing deals more efficiently.

3. Leveraging Mortgage Calculators for Competitive Advantage

Incorporating a mortgage calculator into NEXA’s listings gave the agency a competitive edge. Buyers are more likely to engage with listings that provide comprehensive financial information, and by offering this valuable tool, NEXA stood out from the crowd.

Demonstrating Industry Expertise and Adding Value to Property Listings

1. Establishing Credibility and Building Client Relationships

Integrating a mortgage calculator reinforced NEXA’s credibility and expertise in the real estate market. By providing buyers with a valuable financial tool, we added value to property listings and strengthened client relationships based on trust and transparency.

2. Educating Buyers on Financing Alternatives and Mortgage Climate

The mortgage calculator enabled NEXA to educate potential buyers on various financing alternatives and the current mortgage climate. By offering this knowledge, we position NEXA as a reliable source of information, empowering buyers to make informed decisions.

3. Expanding the Services Offered by Estate Agencies

The integration of a mortgage calculator allowed NEXA to expand its services beyond traditional property listings. By offering a holistic approach to homebuying, NEXA became a one-stop-shop that caters to the needs of potential buyers, fostering long-term relationships.